salt tax deduction explained

However many filers dont know how the. The pre-cap SALT deduction allowed people to deduct some state and local taxes to offset federal tax payment effectively subsidizing state and local taxes for taxpayers.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

The federal tax reform law passed on Dec.

. The Tax Cuts and Jobs Act capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. Indeed research suggests that the SALT deduction is associated with increased revenues from state and local sources.

Under the new law the state and local tax SALT deduction is capped at 10000. That limit applies to all the state and local. Some House Democrats have threatened to block Build Back Better if the broken-up package drops relief for the 10000 limit on the federal deduction for state and local taxes known.

For taxpayers living in states with very high income tax rates taxpayers lose big time. The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for. The SALT deduction and the presence of a cap may impact state decisions about taxation. Since the SALT cap was put into place however very high earners have seen a sharp reduction in the deduction as a percent of AGI from 77 percent in 2016 for those earning over 500000 to 071 percent in 2018.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. 52 rows The SALT deduction allows you to deduct your payments for property. SALT deduction in the news.

The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income. As a result state and local income taxes whether mandatory or elective will be deductible at the level of the PTE and not passed through to individual partners or shareholders of the PTE who are subject to the state and local tax SALT deduction limitation that applies to individuals who itemize deductions for federal income tax purposes. 53 rows The value of the SALT deduction as a percentage of adjusted gross income AGI increases with a taxpayers income.

According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. Higher-income households are more likely to itemize so they are more likely to claim the deduction. The state and local tax deduction has two parts.

WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. SALT stands for the state and local tax deduction that taxpayers can claim when they dont take a standard deduction and choose to. A deduction for statelocal property taxes.

The SALT deduction has the effect of making it cheaper for states and localities to raise taxes on high-income people. In 2016 taxpayers with AGIs between 0 and 24999 claimed in aggregate SALT deductions worth only 23 percent of AGI whereas taxpayers with incomes of 500000 or higher claimed deductions worth 77 percent of AGI. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

Unfortunately especially for higher income households the SALT deduction has been capped at 10000. SALT helps the wealthy and residents of high-tax states the most. In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the.

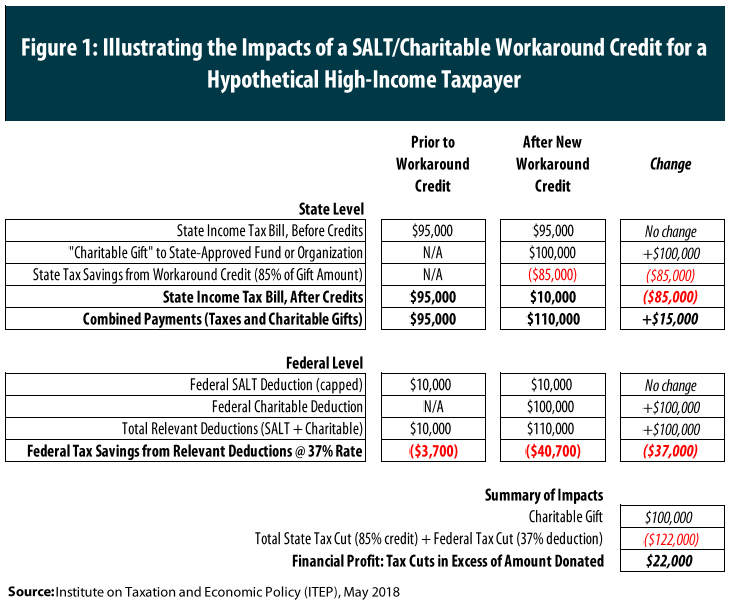

While most filers are still better off due to lower rates and other reforms some states appreciated the degree to which the uncapped deduction lowered the effective cost of their own taxes and have sought to develop workarounds to retain the old benefitplus. The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize. The new SALT deduction allows taxpayers to deduct their sales tax state income tax and property tax up to an aggregate 10000 limit.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly.

Capping the deduction in 2017 reduced the benefit for people who. About 10 percent of tax filers with incomes less than 50000 claimed the SALT deduction in.

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Paura Imperdonabile Funzionari What Are Federal Deductions Soulpoweredyoga Com

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

State And Local Tax Salt Deduction Salt Deduction Taxedu

Salt Tax Deduction Will Democrats Cut Taxes For The Rich Steve Forbes What S Ahead Forbes Youtube

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

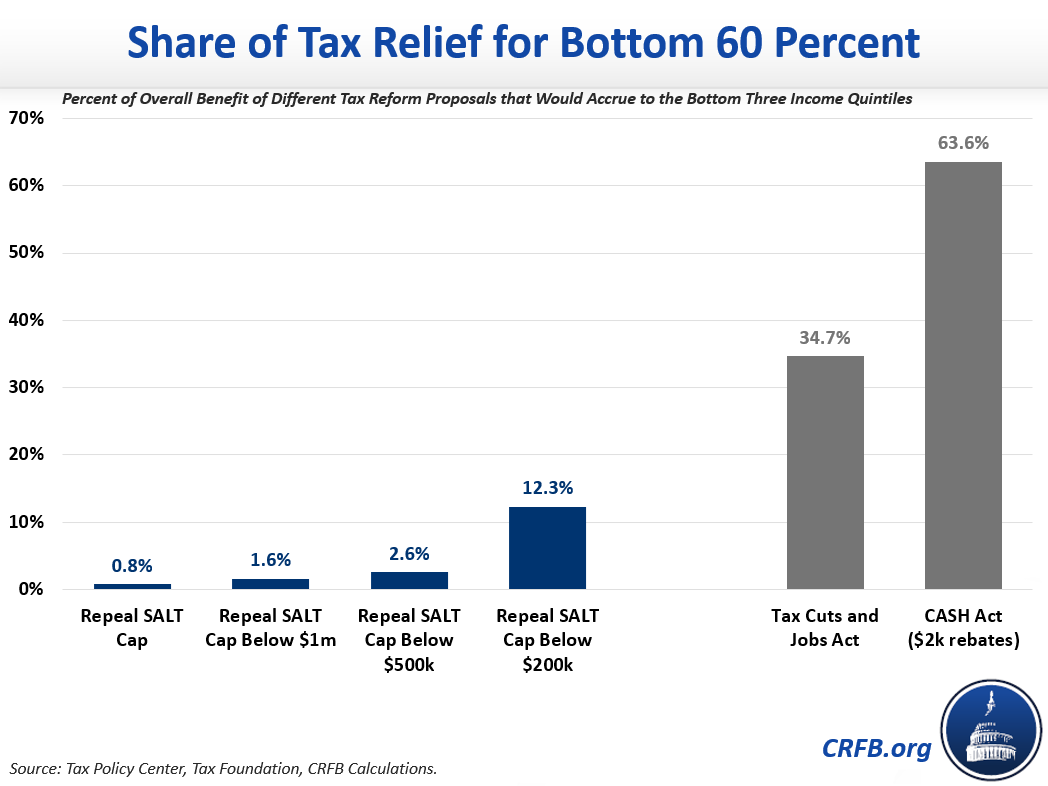

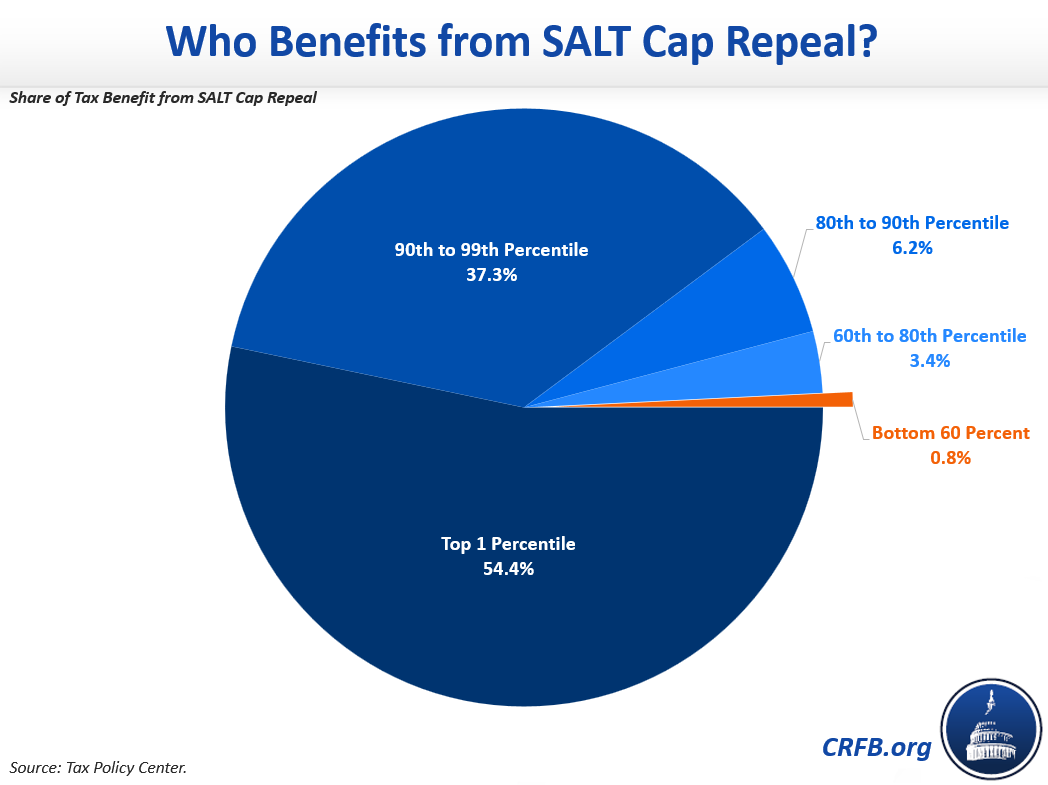

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Salt Deduction Resources Committee For A Responsible Federal Budget

Salt Deduction Resources Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress